DON’T FORGET YOUR WILL IN SPAIN WITH THE NEW EUROPEAN REGULATION

We wouldn’t want to ruin your day by talking about the “other life”, which we hope is a long way away (fingers crossed). However, because of the European Succession Regulation approved on 27 July 2012 and its upcoming application for the succession of people who die after 17 August 2015, I think it convenient to dedicate a few words to foreigners with assets in Spain.

As a starting point, this regulation establishes which jurisdiction applies to the assets of a EU national in a country of the European Union. The law applicable to the succession of a EU national, according to this Regulation, would be that of the country of habitual residence, with the ability to choose to apply the Law of his or her nationality provided that the deceased has stated this clearly and unequivocally in his or her will.

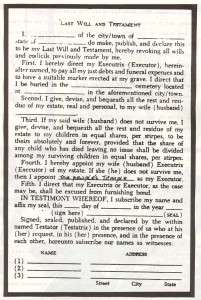

When it comes to Spain, if you are a national of a different country in the European Union but you reside and own assets in Spain, you must know that, if you do not have a Spanish will that clearly and unequivocally states that you would like the law governing your succession to be that of your nationality at the time of death, Spanish law will apply to your inheritance. What does this mean?

In Spain, there is no liberty to leave your property as inheritance to whomever you want. In Spain, the assets of the deceased are divided into three parts. Two of these parts belong to forced heirs, as follows:

- The first part goes to each of the children in equal parts or, in the absence of children, to parents or, in the absence of the latter, to siblings.

- The second part goes to one of the children or, if nothing has been set out, it is divided among all children in equal parts as well, as explained above.

- The third and last part of an inheritance is the freely disposable part and this is the part that the deceased can leave to whomever he or she wishes but, to do this, there must be a will establishing this because, in the absence of a will, it will also be divided among the children in equal parts.

In Spain, a spouse comes last among forced heirs and would only inherit in the absence of these. In other words, if you are a foreigner in Spain and you reside and hold assets in our country, be aware that, if you die without a will or your will doesn’t clearly state that you would like the law of your nationality to apply, your spouse will probably inherit nothing.

The best way to prevent problems of this type is for you to execute a will in Spain and clearly state the Law you would like to apply at the time of your death.

If you happen to have a will in Spain already, it is important for you to review it and verify that it complies with the provisions of the European Succession Regulation or, in other words, that the will you have signed clearly states that your will is for the law governing your succession to be your personal law, i.e. the law of your nationality at the time of your death.

In my opinion, wills that state that “this will is valid pursuant to the personal law of the testator and said law does not cover the concept of forced heirs…” or contain similar words may cause problems under the New Regulation and, in these cases, my recommendation is to execute a new one that clearly states that you would like your succession to be governed by the law of your nationality.

I would like to clarify something that is often confused in these matters. The law governing the succession of a person in Spain is one thing, which depends on what has been explained in this article, but the tax consequences of succession in Spain are an entirely different matter. In this case, we’re referring to Inheritance Tax, which is regulated as explained in our post from March , as payment of that Tax will be due from the fact of inheriting an asset located in Spain, regardless of the Law governing your succession.

Lastly, we wish that you live for many years and you don’t have to worry too much about such unpleasant matters.

Author: Gustavo Calero Monereo, C&D Solicitors (Lawyer)

Torrox-Costa (Malaga/Costa del Sol/Andalucia)