European Certificate of Succession

The European Certificate of Succession is a fairly new certificate that can be requested for international inheritance procedures in the European Union. It can apply to the successions of persons who die with assets in another country of the EU from the 17th of August 2015.

The European Certificate of Succession is a public document of voluntary nature. In some specific cases can save the heir inheritance costs as he will be able to bypass the Spanish inheritance deeds. Likewise, the Certificate avoids translation costs in comparison to the normal national Declaration of Law.

On the other hand, the possibility to use this certificate applies only in few cases and even if so, there are still some economical and practical downsides. This is why it is important to speak to a lawyer specialized in international inheritances first before applying for this notary document in your home country. Also, the regulation of the European Certificate Succession is not valid for citizens of the United Kingdom, Ireland or Denmark.

When does the inheritance procedure for Spanish assets become ´international´?

A Spanish inheritance procedure for assets located on Spanish grounds -like real estate, bank accounts, vehicles, etc.- is characterized as ´international´ once:

- a deceased was officially resident in a country outside of Spain (and -in case he was of Spanish nationality- had no last will appointing the Spanish law to apply)

- or when the deceased was resident in Spain but appointed the inheritance law of his nationality (passport) to apply through a last will. Signing a Spanish of foreign last will appointing your national law mostly is very recommendable. The reason for this is that Spanish law is very limited and you are largely forced to leave to your children. This automatically means that can´t leave your house, properties and assets completely to your heir(s) of choice, like your spouse or partner.

In these cases in which foreign inheritance law applies, the Spanish authorities need to have official written proof from the foreign notary about who the legal heirs for the Spanish assets are according to that foreign law.

Difference between Certificate of Succession and Declaration of Law (or Probate)

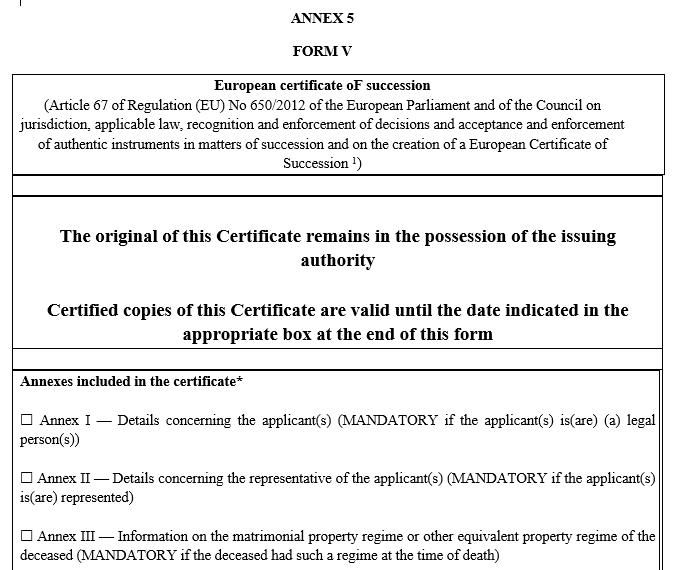

An inheritance procedure is normally done by applying for the national Declaration of Law (or for the U.K. a Probate document) from the foreign notary. Where the Probate for the British is a bit simpler document, both the ´new´ Certificate of Succession as the normal Declaration of Law contains all essential information regarding the inheritance. These are details of the deceased, information about the last will, applicable inheritance law, details of the heir and the assets allocated to the legal heir.

The difference is that the Certificate of Succession is a standard English fill-out format, where the Declaration of Law is an individual text in the national language according to the individual model of that notary. In contrary to the Declaration of Law, the Certificate of Succession is an acknowledged European standard and therefore it needs no legal translation nor an Apostille of The Hague.

The benefits of the European Certificate of Succession

So, the first benefit of using this certificate is that that the legal heir can save costs for the legal translation and Apostille of The Hague. The most important advantage however would be that -in theory and only in certain cases- the Spanish assets can be transferred into the new name without signing the Spanish inheritance deeds at the Spanish notary. This of course saves legal costs. If the deceased has assets in various countries, it might even save several translations.

Are there any downsides in using this international standard?

Yes, unfortunately, there are disadvantages to the European Certificate of Succession in relation to avoiding the inheritance deeds costs in Spain. These are to be taken seriously into account.

1. Valid in very few cases

First of all, it only is valid in few cases, which you can read in the next paragraph. Also, as we already have written earlier, it´s not valid for inheritances for deceased of British, Irish or Danish nationality.

2. Certificate of Succession is more expensive than Declaration of Law

Secondly, although you might save money on the translation and Apostille, your national notary for several reasons might charge more for this international document than for the normal Declaration of Law.

3. Still a lot of documents needed for Spanish inheritance at Land Registry or bank

Thirdly, although you can save the costs of the Spanish inheritance deeds, you´ll still need to provide quite some official documents in Spain to for example the Land Registry or bank. The required documents are:

- International Death Certificate

- Last will or testament (if signed outside of Spain, then a legal translation and Apostille is required)

- A certificate from the Spanish Last Will registry (Registro de Ultimos Voluntades), as is also standard in normal international inheritances.

- Notary document requesting the inscription of the property in the Land Registry in the name of the heir. It needs to be signed by the sole heir. This document can be done by a notary in their own country (in which case it will need a legal translation and Apostille of The Hague). However, it can also be done in Spain.

- Proof of the tax office that the Spanish inheritance tax declaration has been approved (depending on the situation either by the central Tax Administration in Madrid or the regional tax office), of course within the obliged time limit. This also is required for null payments.

4. No guarantee for acceptance, now or in the future

However, the most important downside or disadvantage of using the European Certificate of Succession in Spain is that you don´t have any guarantee that you can avoid signing the Spanish inheritance deeds for the distribution of the assets. The authorities always have the right to request the notary Deeds after all at the moment of the name changes, but also from these or other authorities in the future.

In case you are allowed to, should you apply for the European Certificate of Succession?

These disadvantage points for our law firm -specialized in international inheritances- are the reason to advise our clients not to use the European Certificate of Succession for cases with real estate (house, apartment, etc) thinking you can save the costs for signing the Spanish inheritance deeds. Of course, the document can still be used, for example, if the inheritance only concerns a bank account.

In all cases we advise you to check the costs of the Declaration of Law including the legal translation and Apostille in comparison to the certificate that might be more expensive after all.

In which cases can the legal heir avoid signing the Spanish inheritance deeds?

In those cases in which an heir wants to inscribe a property in his name in the Land Registry (Registro de la Propiedad) with only the European Certificate of Law, the international inheritance case needs to comply with the following requirements:

- Only one heir

- No other interested parties, with the right to a reserved share (like or example the legal ´children´s part´ under Dutch or Belgian inheritance law)

- No curator or authorized person to conduct the inheritance process

- Only for European inheritance procedures, except for British, Danish and Irish

Important: What about the valuation of the properties and the Spanish inheritance tax declaration?

If you do want to use the European Certificate of Succession without signing the Spanish inheritance deeds we have one very important piece of advice: The official value of all inherited assets needs to be included in the certificate. For a Spanish bank account this is done through a bank certificate but for real estate property justifying the value is more complicated. We advise you to speak with your lawyer to avoid any problem with the Spanish inheritance tax declaration, even if the tax payment itself would be zero.

The inheritance value of a property is also very important in a future sale as the Capital Gain Tax will be calculated over the difference between the declared amount in the inheritance and the sales deeds. This of course can make a huge difference in your sales costs.

Specialized lawyer for international inheritances in Andalusia, Spain

There are relatively a lot of European inheritances in Spain, such as Andalusia, Malaga and in particular on the Costa del Sol. The reason for this of course is that there are many foreigners, both resident and non-resident in this area, who own houses and other properties or assets. Also, the fact that the wave of Northern-European senior ´baby-boomers´ have come to live to a high age contributes to an increased amount of succession procedures over the last years.

If you need to arrange an international inheritance for assets located in Andalusia, please don´t hesitate to contact C&D Solicitors in Torrox and Malaga, for legal, fiscal and economical advice for the most efficient procedure. More information about the general inheritance process you can watch in this video: