Changing co-ownership, donation & usufruct

Besides buying or selling real estate property in Andalusia, C&D Solicitors in Malaga also assists in other property transfer like changing of co-ownership, donation (gifting) and usufruct issues. This for example can be done by:

- a. the official Ending of Co-ownership (Extinción de Condominio) due to divorce or separation,

- b. an Ending of Commonhold/Community of Goods (Disolución de Sociedad de Gananciales), or

- c. a gift or donation (Escritura de Donación)

The deeds for these ownership changes need to be signed at the notary in Spain and your lawyer can arrange so through a Power of Attorney. Depending on the kind of deeds the lawyer then pays the taxes and takes care of the changing of the Land Registry (Nota Simple) and the Cadastre records. It might also be necessary that he adjusts the title holder of the service contracts or for example the Spanish Mortgage Deeds. Your lawyer can negotiate on your behalf with the bank for this change.

The changes in (co)ownership mostly are for a percentage of the full ownership of the property. However, it can also specifically refer to the usufruct (right-of-use or in Spanish ´usufructo´) or bare ownership (nuda propiedad). Please see the last paragraph for more information about usufruct and related tax obligations in Spain.

a. End of Co-ownership of your Spanish house (Extinción de Condominio)

The most common reasons for property transfer through Ending Co-ownership by signing the notary deeds of the ´Escritura de Extinción de Condominio´ are:

- Divorce of a couple married in Separation of Goods (for which you need to sign a Nuptial Agreement if this is not the standard in your country)

- Separation of a non-married couple (yes or no inscribed in the Spanish Registro de Pareja de Hecho)

- Any other Ending of Co-Ownership of non-related owners

In the examples below you´ll see that according to the Spanish tax office an ´owner´ isn´t always a person, but it primarily is one singular fiscal identity. This means that it can also be a couple married in community of goods (commonhold).

Taxes for the buyer and seller in an Ending of co-ownership

The End of Co-ownership procedure, Extinción de Condominio, has lower taxes for the ´buyer´ than a normal purchase, because you only pay 1,2% AJD tax (Actos Juridicos Documentados or Stamp Duty) is paid over the percentage of the transferred property and not the usual 7% ITP Transfer Tax. On the other hand, the ´seller´ pays the Capital Gain Tax over the profit and potentially local Plusvalue over his or her part of the declared value of the property, just like in a normal sale.

For example, if the house in Andalusia -owned by a couple married with a nuptial agreement (separation of goods)- has a market value of 300.000 euros and the division is 60% for the person that will keep the house and 40% of the selling party, then the taxes are:

- Buyer: The tax base is 40% of € 300.000, so € 120.000 multiplied by 1,2% AJD Tax which comes down to € 1.440.

- Seller:

- Plusvalue/Plusvalia: A 40% of the local profit tax over the increased worth of the ground, counted over the years of ownership (to be calculated by the lawyer). This tax is mostly charged over urban properties and only occasionally over rural properties.

- Capital Gain Tax: The tax base is 40% over the official profit according to the buying and selling deeds minus certain deductions. Non-resident sellers will then pay a Capital Gain tax rate of 19% over the net profit.

Both parties can also agree to a lower price as long as this is a higher amount than the minimal fiscal value (your lawyer can calculate this based on the cadastral value). This to avoid problems with the Spanish tax office. Also, the payment or financial compensation (for example within the divorce papers) must be justified, otherwise this change of ownership would be considered a donation or gift.

Examples of property transfer by Ending of Co-ownership vs. normal purchase/sale

- A couple married in Separation of Goods or a non-married couple splits up. The buying party pays only AJD Tax because the Co-ownership has officially ended.

- 2 Couples jointly own a holiday home in Malaga. At a certain point couple A wants to sell its part to couple B, which is married in Community of Goods. Couple B only pays AJD tax instead of ITP Transfer Tax, because only 1 fiscal identity will keep owning the property.

- 2 Couples jointly own a property in Nerja. Couple A wants to sell its part to couple B, that is married in Separation of Goods or is a non-married couple. Couple B pays the higher Transfer Tax through normal purchase/sales deeds, because 2 fiscal identities will keep owning the property. In legal terms this means that there is no official Ending of Co-ownership.

b. Donation or Gift (Escritura de Donación) of Spanish property

If the receiving party (donee) doesn´t pay for the value of an ownership transfer of property in Spain, then it´s considered a donation (gift). According to your relationship, the donee might need to pay donation tax or gift tax and, of course, both parties need to sign Donation Deeds at the Spanish notary. Only this way the change in ownership can be formalized in the Land Registry and Cadastre in case it concerns real estate property like a house or apartment.

Money donation

Will receive a (larger) money donation or gift and are you a fiscal resident in Spain? Officially also in this case both parties need to sign the donation deeds and declare the donation to the Spanish Tax Office. This needs to be done so even if the tax payment is (almost) null because it´s a gift between close family members like parents and children.

Are you a fiscal resident in Spain and want to donate or gift money, for example to your children in the UK, Sweden or the Netherlands? Then the notary and tax declaration obligation depends on where you have the money. If it´s in a foreign bank account (just as it would be a house in your home country), then you don´t need to sign deeds or declare donation tax in Spain.

Donation or Gift Tax in Andalusia

Donation Tax for the receiver is very similar to Inheritance Tax, so we recommend reading our page about this subject. The most important factor is the relation between the donor (in Spanish donante) and the receiver (in Spanish donatario). This means that in Andalusia spouses, couples inscribed in the Registro de Pareja de Hecho, children, grandchildren, parents and grandparents practically don´t pay any tax (Box I and II).

For this reason, it´s logical to declare the market value in the donation deeds to avoid high Capital Gain Tax in the future. If the donation however is done to a person in box III or IV, then the tax will be rather high. In this situation you can also decide to declare a lower value. This value, however, can never be lower than the minimal fiscal value which your lawyer mostly calculates through the Cadastre value.

Do you want to avoid a transfer being considered a gift or donation because of the high donation tax for the receiver? Then you of course need to sign normal sales/purchase deeds (or in certain cases deeds for Ending of Co-ownership, the Extinción the Condominio). Crucial is to either to add the bank receipt of the actual money transfer in the deeds or to state that you already made the corresponding payment in your home country.

Plusvalue and Capital Gain tax on donations

Please note that with donation or gifts of a Spanish house by law the receiver pays Plusvalue/Plusvalia tax and not the donor. The local Plusvalue in Andalusia is charged in ownership changes of urban property and only in few cases of rustic/rular houses.

The donor that is a fiscal resident in Spain on the other hand does need to pay his Capital Gain Tax in this next year´s IRPF over the donated value (so minimally the refference value of the Cadastre). This is the same as in normal sales or in the ending of co-ownerships. If the donor of Spanish property is a non-fiscal resident, then you need to declare the Capital Gain Tax in a special tax declaration to the Spanish Tax office within a certain time limit. In this last case the 3% obligated reduction for non-fiscal residents, however, doesn´t apply because it concerns a donation and not a sale.

Donating vs. inheriting in Spain

Sometimes people want to donate Spanish property think they can avoid inheritance tax for an heir in box III or IV when inheriting by already donating (potentially without the right-of-use/usofruct). However, as both Donation Tax (Gift Tax) and Inheritance Tax are practically the same for the receiver, this doesn´t make much sense. It also has the disadvantage that the person that makes the donation needs to pay Capital Gain Tax -if applicable- and would lose all freedom to for example buy another house if your current dwelling doesn´t match your needs anymore.

Another wish for donating sometimes is that the property owner deliberately wants to exclude a legal heir from the future inheritance. This can for example be a Dutch or Belgium child with the legal right to his child´s part. Or, it could also be if the owner is of Spanish nationality or is a resident in Spain without a signed last will appointing his national law to apply. In theory, the legitimate heir has the legal right to later -after the owner has deceased- fight the earlier donation in court and try to claim financial compensation from the current owner.

Do you have a complex legal situation for changing ownership like through donation? Ask your lawyer at C&D Solicitors about legal and fiscal advice for your personal circumstances. In the light of inheritance and signing a Spanish will, you might also want to read the paragraph below: Legal rights when co-owning usufruct (f.e. through an inheritance).

c. Ending of Commonhold / Community of Goods

If you are married in Community of Goods/Assets (this is the standard in for example Holland/The Netherlands and Belgium), then you need to sign other kinds of deeds for the Ending of Commonhold. In this case you sign the notary deeds for Ending of Commonhold (´Escritura de Disolución de Sociedad de Gananciales´) to register/inscribe real estate or other properties in the sole name of the remaining owner.

Avoid high taxes due to Over-Allotment through a correct divorce agreement

Important: Please note that the Spanish tax office is strict in this matter and if you don´t arrange your foreign divorce papers well, you could end up paying unnecessary taxes. C&D Solicitors advises putting all official values of all Spanish and foreign assets in the divorce agreement. This way you can prove if you have split all assets evenly 50-50, so you don´t need to pay any taxes in Spain over the extra value, or ´Exceso de Adjudicación´ (Over-Allotment). The Tax Office would consider any unevenly divided value a donation or gift over which you pay Donation Tax. This, of course, would be in the highest tax scale of non-related persons as you already have divorced.

Property transfer: Difference between usufruct (right-of-use), bare property and full-ownership

If you speak about a change of ownership or co-ownership, then you need to understand that legally the is the sum of both the ´usufruct´ (usufructo) plus the ´bare property´ (nuda propiedad). The usufruct is a (mostly) lifelong right-of-use of a real estate property, which legally automatically dissolves when the usufructuary dies. This unless another limitation period is specified.

Legal rights when co-owning usufruct (f.e. through an inheritance)

The Spanish law states that no one can be forced to co-own the usufruct of a property if they don´t want to. This means that if 2 usufructuaries can´t agree about -yes or no- selling a property, the person that wants to sell could start a court procedure for the auction of the property. This doesn´t happen often, because the property might be sold for a lot less than it´s worth to the highest bidder. Nevertheless, it is a legal option in case of conflict. This is important to know for inheritances in Spain and appointing your legal heirs through a last will.

Let´s say a newly married couple co-owns a property 50-50, but both have a child from an earlier marriage. As there is no inheritance tax in Andalusia between spouses nor between parents and children, most couples firstly want the longest-living partner to inherit their 50% of the property. The children usually only are put as a substitute in the will in case the partner would already have died. However, in this scenario you don´t have any guarantee that your inheritance will indeed finally go to your child. In Spain you simply can´t register this limiting condition in the Land Registry like in other European countries.

This means that your new partner can always change his last will (testament) after you have died and leave the total property to only his or her own child. However, if you leave the full ownership of the Spanish property directly to your child, your partner doesn´t have the guarantee to keep living in this house. In that case it´s advisable to leave the bare property of your 50% to your child and the life-long usufruct to your partner.

Tax obligations for usufruct in Andalusia

Both legally and fiscally the usufruct represents a percentage of actual ownership of a property. This means it also has a fiscal value over which both parties need to pay proportional taxes, just as any other house owner. This tax obligation concerns for example:

- Buying usufruct:

- ITP Transfer Tax when buying the usufruct of an existing property in Spain

- VAT and AJD when buying the usufruct of a New Build Promotion from a developer

- AJD Stamp Duty when you as the owner of the nude property buy the usufruct from the usufructuary (Ending of Co-ownership / Extinción de Condominio). (However, this is open to interpretation of the Land Registry as they also might make you pay the higher transfer tax.)

- Inheriting usufruct:

- Inheritance tax (if you are in tax box I or II, the inheritance tax will practically be 0%).

- Receiving usufruct by donation or gift:

- Donation Tax (if you are in tax box I or II, the inheritance tax will practically be 0%).

- Selling or donating usufruct:

- Capital Gain Tax and Plusvalue/Plusvalia

- Owning usufruct:

- Also, for owning the usufruct of a house or apartment you need to pay yearly income tax in the form of IRPF for tax residents or IRNR for non-fiscal residents in Spain.

Calculation of usufruct percentage of property ownership in Spain

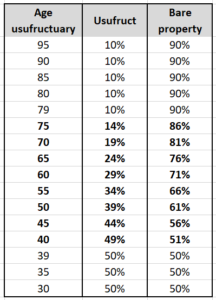

What makes the usufruct special, is that it´s a flexible percentage of ownership. It´s based on the age of usufructuary and therefore it lowers every year by 1%. This automatically means that the percentage of the bare property rises 1% every year as well. The formula or calculation is the number 89 minus the age of the usufructuary, with a maximum of 50% and a minimum of 10% ownership.

Ending of usufruct (Consolidation of Ownership)

The usufruct normally ends when the usufructuary dies. However, it can also be when he sells or donates his rights or for the officially agreed time limitation in the Ownership Deeds. When the usufruct ends the Land Registry records need to be corrected by signing a special deed at the notary ´Consolidation of Ownership´ (Consolidación de Dominio). In case the reason is death, the original death certificate of the deceased needs to be provided to the notary. The beneficiary or receiver normally pays AJD tax (Stamp Duty) over the fiscal value of the usufruct (this might vary per Land Registry).