SPANISH INHERITANCE TAX 2021: 10 THINGS YOU NEED TO KNOW

Are you a resident or homeowner in Spain and did you ever wonder about Spanish Inheritance Tax? Whether you maybe own a house and other assets or are thinking about buying property in Spain as an investment, this information could be useful to you.

I’m going to try to clear up some common doubts and make several example calculations so that you understand how this tax works in Spain and its current rates in Andalusia.

As a law firm specializing in providing legal and fiscal advice to foreigners in Andalusia, we’ve encountered certain unpleasant situations in inheritance processes with clients. These cases had a large financial impact from inheritance tax (succession rights) and some of them could have been avoided with the right fiscal advice and preparation.

1. Be careful with Spain! Every region has a different Spanish inheritance tax

The big difference in terms of paying more or less inheritance tax in Spain depends on the autonomous community where you reside, as they each have different regulations, with very different tax rates.

If you’re worried about how much inheritance tax an heir will pay, you need to know the benefits available in the autonomous community where you have your assets or where you’re thinking of buying a home.

2. Yes, that’s right. Non-residents in Spain pay the same Inheritance Tax as residents

There is an obligation to pay Inheritance Tax in Spain when a person inherits any asset located within Spanish territory, irrespective of whether they are resident in Spain. Since the judgments rendered in Spain in 2018, residents and non-residents, whether they are EU citizens or not, are subject to the same regulations in terms of Inheritance Tax in Spain.

In other words, if you’re an expat or reside in your country of origin, this will make no difference in terms of the tax to be paid compared to what someone resident in Spain would pay.

Be careful! You should not confuse Inheritance Tax payable in Spain with the law governing the Spanish inheritance process and the law of obligatory heirs in the Spanish Succession Law. If you want to know what this means, please watch C&D Solicitors´ video:

3. Who collects the Spanish Inheritance Tax for non-residents?

The only difference between residents and non-residents is the administrative body in charge of collecting the tax. If you’re resident in Spain, the administrative authority to collect this tax will be the autonomous community where you reside but, if you’re a non-resident, this will be the non-resident department of the central administrative Tax Office in Madrid.

However, even if you’re non-resident and inherit a property in Malaga, for instance, and you declare this tax to the Treasury in Madrid, you can still benefit from Andalusian tax regulations, which is why non-resident heirs in Spain pay the same as residents.

4. What is the most expensive Inheritance Tax region in Spain?

Andalusia is currently one of the regions in Spain where the lowest inheritance and gift tax rates for direct relatives of the deceased are applied, due to the tax bonuses and exemptions introduced in the last few years. Cantabria and Galicia are two other communities with the lowest Inheritance Tax rates in Spain, along with Madrid, Extremadura and Murcia. However, communities such as Asturias, Castilla y Leon and Valencia have very high rates of Succession Tax.

Nevertheless, these changes haven’t affected all groups of heirs and it continues to be a very expensive tax for some distant relatives, as well as for heirs with no official family relationship to the deceased.

So, if you for example are thinking of investing your money in buying a house for a tourist rental in Spain, in terms of succession tax the Costa del Sol (Andalusia) is much more attractive than the Costa Blanca (Alicante).

5. How is the succession tax calculated for a Spanish estate?

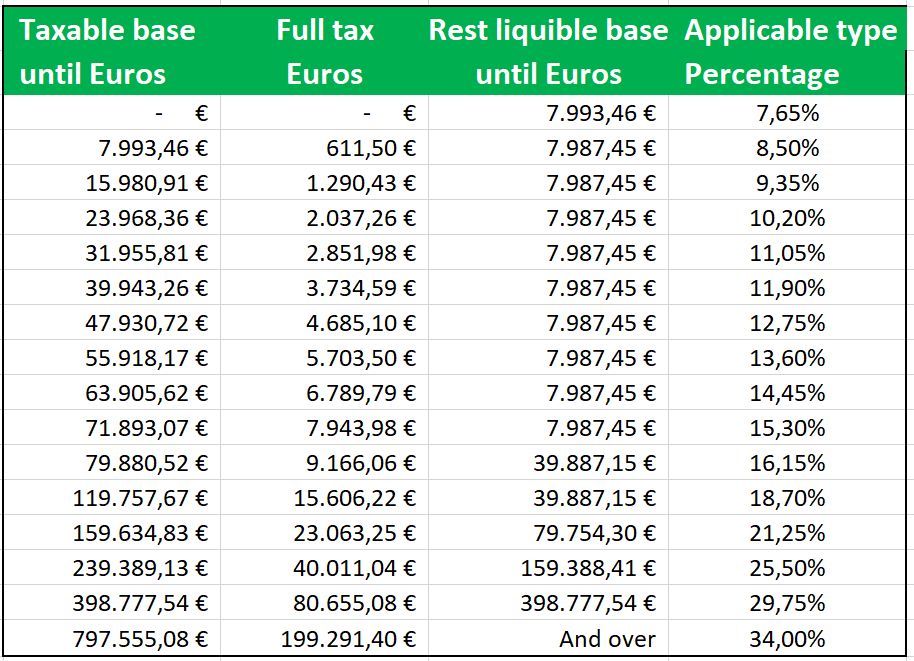

The rate of this tax is progressive, according to the value of the estate, i.e. the higher the value of the assets, the higher Inheritance Tax becomes.

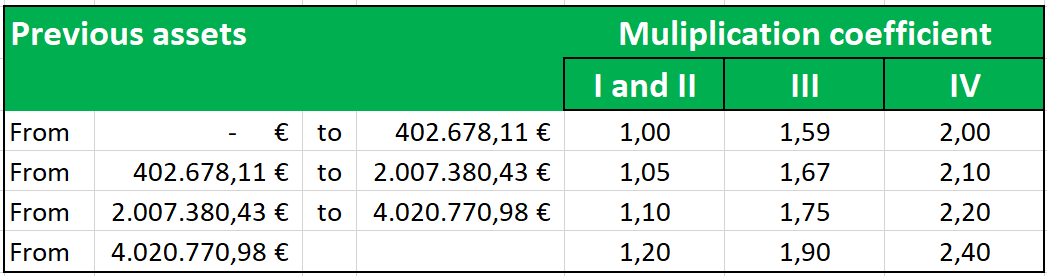

Likewise, to the result obtained when applying the scale for this tax, multiplication coefficients are applied, which may increase the amount due under this tax. According to the degree of relationship and the pre-existing assets of the heirs, this coefficient may be higher or lower.

The lower the degree of relationship to the deceased and the greater the assets of the heir, the higher Inheritance Tax becomes.

6. Which heirs pay the least tax?

Descendants or (adopted) children, as well as spouses and ascendants. This means that children, husbands/wives, grandchildren and parents pay the least inheritance tax in Spain. These are relatives classified into groups I and II under the Tax.

It should be noted that the tax benefits existing for direct relatives are very different depending on the autonomous community where the assets are located or where they live and reside, as each autonomous community has its own regulations. Differences in Inheritance Tax rates in Spain are enormous!

7. How much Spanish inheritance Tax is paid by close relatives in Andalusia?

This group of heirs is included in groups I and II and they can apply a reduction due to kinship of up to 1,000,000 euros per heir in Inheritance Tax. If each of them inherits less than that amount, no Inheritance Tax will be due.

For heirs to apply this reduction in Andalusia, their own assets prior to inheriting cannot exceed 1,000,000 euros either. Without a doubt, in Andalusia, widowed spouses and children pay much less Inheritance Tax than in other autonomous communities in Spain, which has resulted in an appreciable drop in tax collection from this tax in Andalusia.

8. Which heirs pay the most SuccessionTax in Spain?

Persons related collaterally in the 2nd and 3rd-degree family, such as siblings, nephews, nieces and brothers– and sisters-in-law, as well as other more distant relatives such as cousins, great-uncles, great-aunts and strangers.

Without a doubt, these are the heirs that pay the highest Inheritance Tax rates in Spain and they’re classified under groups III and IV of the Tax. In Andalusia and other Autonomous Communities, this group of heirs aren’t the exception and pay a very high rate of inheritance tax.

9. How much tax is due for inheriting the usual property in Andalusia?

If you’re in groups I and II, unless the home is worth over 1,000,000 euros, you would pay nothing. But if the heir is in group III, such as a sibling, uncle, aunt, nephew, niece, or in-law, living with the deceased for at least the two years prior to the death occurring, a bonus worth 95% to 100% of the value of the home is applied. In the latter case, the home must be kept for 3 years following the death.

There are other discounts in Andalusia, such as heirs with disabilities, the acquisition of a sole proprietorship and farms.

10. What is the deadline to pay Inheritance Tax?

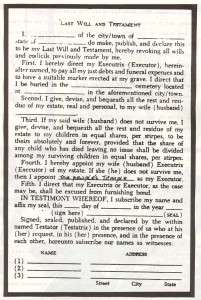

The deadline is 6 months after the date of death and, if it remains unpaid, the tax administration may initiate proceedings to claim payment of the tax, with the ability to impose penalties. However, if there are justifiable reasons, it is possible to request an extension of 6 additional months and this application must be filed within 5 months of the death.

After four and a half years from the date of death, the government cannot require payment of this tax. In this case, the tax would be zero due to it being time-barred.

EXAMPLES: Spanish Inheritance tax calculator in Andalusia

- Dutch siblings Frank and Mark inherit their father’s property in Almuñécar, appraised at 300,000 euros. In this case, the answer is clear, each of them would pay zero in Inheritance Tax.

- Now siblings Frank and Mark inherit their older brother Jan’s property in Fuengirola, appraised at 300,000 euros. In this case, each would inherit 50% of the property, appraised at 150,000 euros. The only bonus that they may apply is for the first 7,993.46 euros, for which reason each of them would pay the Treasury an amount of €31,393.56

- Lastly, siblings Frank and Mark inherit their friend Martin’s property in Marbella, appraised at 300,000 euros. In this case, each would inherit 50% of the property, appraised at 150,000 euros. No reduction can be applied in this case, for which reason they would pay taxes on the entire amount received, resulting in a payment of €42,523.07 from each.

Final note: How does the Spanish Inheritance and Gift Tax affect the property market?

If you’re thinking about buying a home in Spain and you’ve read everything we’ve explained above, you’ve probably realized that Inheritance and Gift Tax have a significant influence on the property market in Spain and the choice of the autonomous community to settle in.

Excessively high rates in some regions and extremely low rates in others condition the investment decisions of potential home buyers to these trends. Inheritance Tax (succession rights) in Spain has a direct impact on the financial behavior of buyers and the decision regarding where in Spain they wish to live or buy a property.

You can read interesting information about this subject on our webpage Inheritance Tax Andalusia. If you need a lawyer specializing in Inheritance and Gift Tax, just send us a message through the contact form below.

If you are interested in the subject of Spanish inheritances, you might also want to read our pages on:

- Spanish inheritance law

- Last will (testament)

- Inheritance tax Andalusia

- European Certificate of Succession

Author: Gustavo Calero Monereo, lawyer at C&D Solicitors, Torrox (Malaga)