KNOW BEFORE YOU GO: BUYING PROPERTY IN SPAIN AS AN AMERICAN OR CANADIAN CITIZEN

The remarkable rise of property transactions in Spain by US and Canadian citizens was driven partly by the options to reside in Spain, with a favourable tax status for buyers. The real estate market in some areas as the Costa del Sol (Andalusia) has grown strongly in recent years.

Residence permits, such as the Golden Visa in Spain or the Digital Nomad Visa and favourable exchange rate plus the greater frequency of flights between Spain and the US have increased sales. According to www.idealista.com there´s an increase of 90% since 2019.

Can a US or Canadian citizen buy property in Spain?

Yes, all they need is the money to buy, the desire to do it and a good exchange rate. Otherwise, there are no substantial differences between a property purchase by a US citizen or a Canadian or British citizen compared to a European citizen.

I understand that the answer may be simplistic but it isn’t since, because of the European Directive on the Prevention of Money Laundering, the European Union (EU) publishes a yearly list of countries that represent a threat to the financial system of the European Union.

Citizens resident in the countries that appear on this list have a very hard time acquiring a property in Spain, when the funds come from these countries.

Why buy property in Spain?

The prestigious American newspaper The Wall Street Journal emphasised this growth in an article published in February this year. This article analysed that prices per built square metre in different Spanish cities, such as Marbella, Malaga and Madrid, in comparison to American cities, were still very attractive for American investors.

In Spain the province of Malaga is a pole of attraction for American property investors with a constant increase in US investors with great purchasing power. Many of them interested in exclusive and luxury properties.

Benefits of investing in real estate in Spain

Spain is a very interesting country for foreign investment in real estate. The Spanish and autonomic governments have been increasing tax benefits to attract foreign investors and encourage the purchase and sale of real estate. Also the profit in the renting, purchase and selling of properties has been increasing in cities like Malaga, Seville or Madrid in the last few years. Many people and investment companies are interested in the Spanish real estate market because of its legal security, culture, climate and lifestyle. Especially the Mediterranean coast and Costa del Sol.

Currently, the dollar vs. euro exchange rate continues to be favourable to the American dollar, so this change makes investing in real estate in Spain more attractive for North American buyers.

What is the process of buying a property in Spain?

Basically, as a very short summary, we can differentiate the following steps in the legal process to purchase a property in Spain.

Reservation contract

A small deposit is paid to the estate agent or seller to take the property off the market and a period of 2 to 4 weeks is provided to sign the private contract. On many occasions this reservation contract is prepared by the estate agent. But your lawyer can take a look at it and suggest changes, if necessary.

Private Sale Contract

This is the main document governing the purchase of a property, where the buyer pays 10% of the purchase price. All the obligations of both parties are established until the signing of the public deed of sale on the date of the sale. If the property to be acquired is under construction, i.e. if the seller is a developer, the provisions of the contract and the amount payable are different to those that would apply to an existing property.

Signature of the Public Deed of Sale

This document is signed before a notary and, when it is signed, the buyer pays the rest of the price and receives the keys to the property. From that moment, the buyer will be the full owner of the property. It’ll be very important to obtain home insurance and an alarm system to prevent squatting problems in the property. Especially if the property will be vacant at different times of the year.

Payment of Taxes & Property Register

Once the Public Deed is signed, it will be necessary to pay the Tax on Asset Transfers (ITP) or Legal Deeds (AJD) for a new property, so the property can be registered in the Cadastre and the Property Register. This last phase will entail registering to change the name of the different utilities.

Legalities of Property Purchase in Spain for Americans and Canadians

Obtaining an NIE (Número de Identificación de extranjeros)

When the reservation is signed, the buyer will have to obtain a Spanish NIE (foreigners’ fiscal identification number), as well as provide the necessary financial documentation to comply with money-laundering regulations. This documentation should be provided by your law firm and/or the financial entity in Spain where you will open a current account, as appropriate.

Getting s Spanish Mortgage for purchase a property

If the buyer needs a Spanish mortgage to acquire the property, the best option is to try to obtain its approval between signing the reservation and signing the private sale contract.

We have published a long document about the process of buying a property in Spain. Here you can find all the details about this process.

Why is it important to hire a lawyer to carry out the property due diligence?

Buying a property in a country different from the one where the person is from without proper legal advice is an unnecessary risk. Especially because the legal cost of a lawyer is very low, in comparison to the other costs involved in a property purchase. Such as the price, the estate agents’ fees or taxes.

A law firm specialising in property law will give you peace of mind throughout the purchase process, giving you an explanation of all the details about the property and answering any questions that may arise.

Real Estate Due Diligence in Spain for American and Canadians

It’s important for the law firm representing you in your purchase process to include property due diligence, where the entire legal, planning and tax situation of the property is put down in writing. With this document, you’ll have all the relevant information about the property in writing and making the decision to buy it will be more satisfactory.

Likewise, it is ideal for the due diligence to take place before the private sale contract is signed. So when you pay 10% of the price, you’ll have all the relevant information about the property, reducing the risk of problems arising during the purchase process.

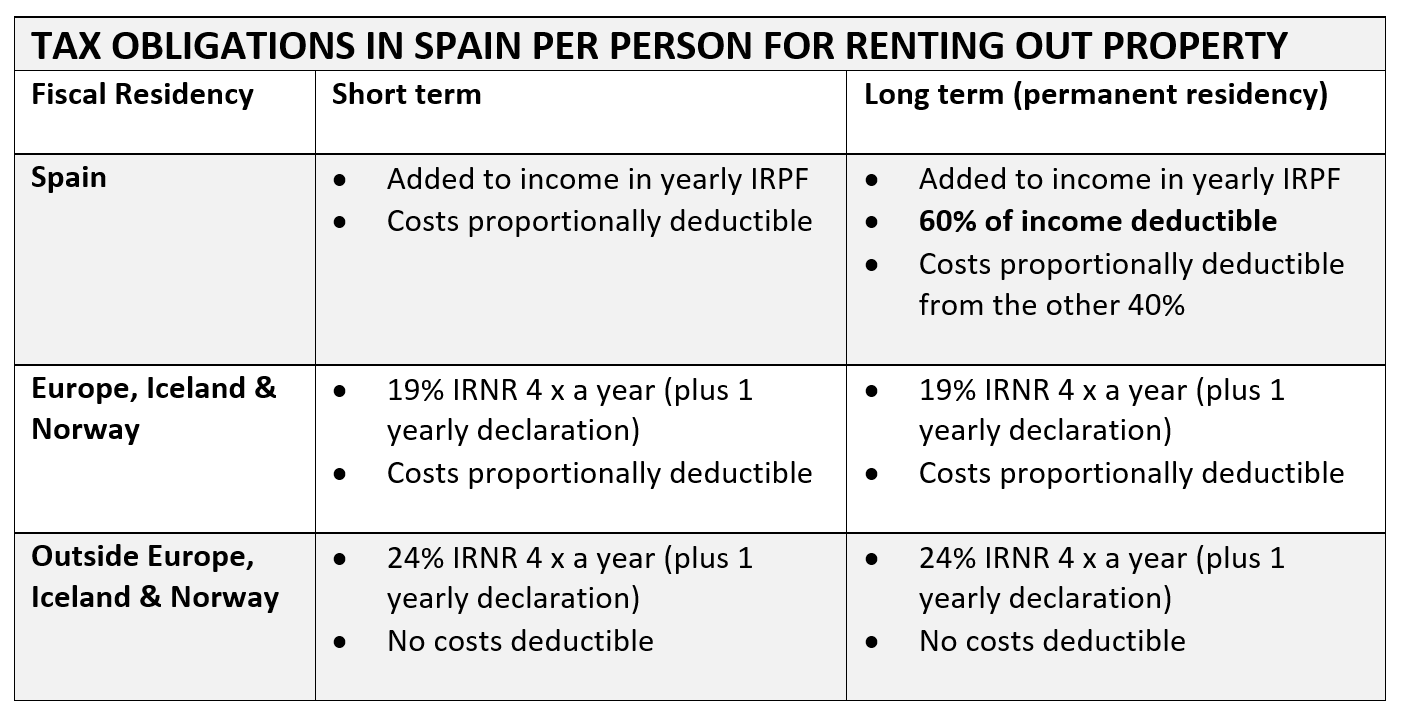

Tax Considerations for Americans and Canadians Buying Property in Spain

A law firm specialising in property and tax law will also adapt the due diligence of the property investment, depending on whether the buyer is an individual or a company. This as well as on whether the buyer intends to make an investment to operate a business activity, such as holiday lettings. Good tax advice to reduce taxes paid and maximise the returns on your investment is essential in the process of buying a property in Spain.

The purchase of a property and the Golden Visa for US citizens

The Golden Visa is a special visa for non-EU citizens to reside in Spain. The main requirement of which is to purchase one or more properties, for a minimum total price of 500,000 euros without a mortgage.

There are other requirements to obtain a Golden Visa but generally meeting these requirements isn’t a problem or isn’t generally one. The important thing is to make a financial investment in buying a property.

Qualifying for the Spanish Golden Visa

A Golden Visa enables holders to reside in Spain and move freely throughout the Schengen area, without being considered tax resident in Spain just for having this visa. A person with a Golden Visa will not be considered tax resident in Spain and will continue to pay taxes in the country of origin. Being considered tax resident in Spain will only happen when the person remains in the Spanish territory for over 183 days per year.

The visa for digital nomads for non-EU citizens

This visa allows holders to work remotely in Spain, either for a foreign company or as a freelancer, provided that at least 80% of the income comes from foreign clients.

The greatest tax advantage is that digital nomads are considered non-resident in Spain for tax purposes, i.e. they will only be taxed in Spain for income obtained from working remotely in Spain for a foreign employer or for a foreign client, if they are freelancers. For administrative and immigration purposes, digital nomads are resident in Spain.

These workers will not need to file form 720, will not need to file Wealth Tax and, for the purposes of other Tax Agencies, they are considered tax resident in Spain.

The Spanish tax for income obtained for digital nomads

The tax for income obtained from working remotely will be taxed in Spain at a flat rate of 24% on the first 600,000 € for a period of 5 years. Without a doubt, this flat-rate tax is very favourable, as a tax resident would pay up to 47% for such earned income.

Double Taxation Treaties with the US and Canada

The key question that may arise on this point is whether this income received by working remotely in Spain, on which a tax rate of 24% is applied in Spain, would be subject to taxation in the country of origin. The answer will depend on whether there is a double-taxation agreement between Spain and that country, and on the contents of the agreement.

Since a digital nomad is tax resident in Spain and can obtain a certificate of tax residence, these international agreements can be applied. Spain currently has 99 double-taxation agreements in force, including the EU-countries and:

- USA

- Canada

- United Kingdom

- Saudi Arabia

- Switzerland

- Morocco

- Rusia

- China

- South Africa

- Mexico

- United Arab Emirates

Additional Tips for a Smooth Property Purchase in Spain

If you are planning to change your life and thinking about residing or working remotely from Spain or simply invest in the purchase of a property in Spain, don’t hesitate to contact us. Our lawyers will help you throughout the entire buying and selling process.

At C&D Solicitors we specialise in providing property advice to foreign clients. Whether individuals seeking to buy a second home or an investment property in Spain, as well as investment companies or investment funds seeking to grow their asset portfolio and take advantage of the capital gains they can obtain in the property market and in property operation.

We offer “full service” advice throughout the process in your native language: English, Dutch, Swedish, French and German. You can call us at +0034 952 532 582, send us a WhatsApp message at +34 639 54 16 02 or write to us at info@cdsolicitors.com. We’ll look into your case, we’ll send you information about the process and a cost estimate for this, with no commitment whatsoever.