TAX PAYMENT FOR RENTING OUT YOUR SPANISH HOME

Information on tax payment for renting out when you investi in a property in Spain: The number of foreigners interested in buying a property in Spain as an investment or just to be able to enjoy their holiday periods is constantly increasing. Over the last few years, the rental market, in particular tourist rentals, has grown enormously in Andalusia, especially cities on the Costa del Sol and the Costa Tropical, such as Málaga, Nerja, Almuñécar, Marbella, Benalmádena, etc.

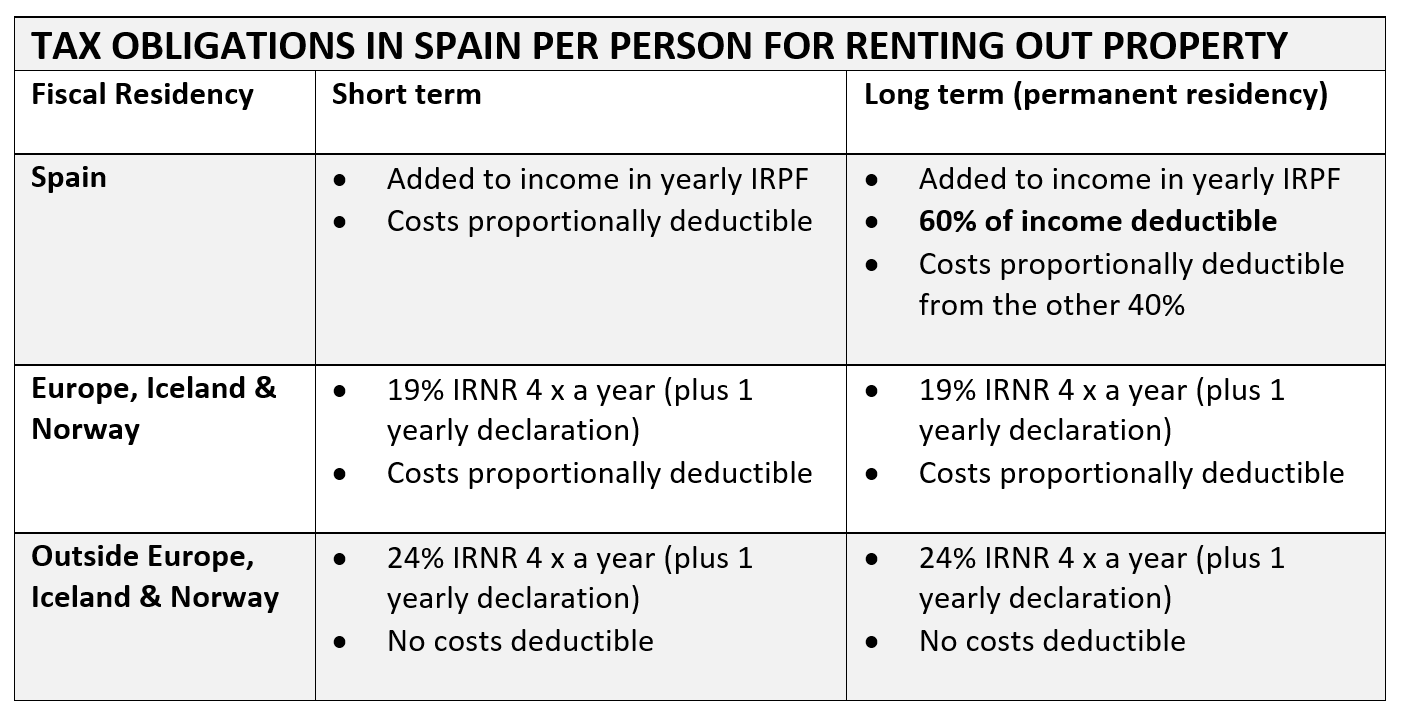

More than a few home buyers in Spain are attracted by investment prospects through the earnings obtained by renting out their property. As expected, earnings obtained from renting such properties -either through a permanent contract or through holiday rentals- must be declared in Spain by both fiscal residents (yearly IRPF tax) and non-fiscal residents (quarterly IRNR tax).

What taxes are currently paid by non-Spanish residents?

Since 2016 citizens resident in the European Union, Iceland or Norway have to pay 19% of the profit obtained from rentals. Non-EU citizens must pay 24% of the earnings obtained from renting out their properties. This difference in taxation has resulted in a complaint to the European Commission for discrimination of non-EU citizens, which is pending resolution on the date of publication of this article. This of course is an important matter for British home owners after the Brexit, because when Great Britain leaves the EU under the current ruling they would be considered Non-EU citizens and would therefor pay more taxes.

Can non-residents deduct expenses?

Citizens non-resident in Spain but resident in any country of the European Union, Iceland or Norway can deduct the same expenses as citizens resident in Spain for short-term rentals. The only exception would be for properties rented as permanent homes of the renter as residents in Spain can deduct 60% of what is paid by the tenant while non-residents cannot apply this deduction. Official costs can only be deducted proportionally depending of the total amount of days that the property was rented out. For example, if you rent out 90 days a year, you can only deduct 25% of the yearly costs. Citizens not resident in the European Union, Iceland or Norway cannot apply any type of tax deduction, for which reason they would pay IRNR-taxes on the gross profit received from renting the property.

Tax payment for renting out

What expenses can be deducted?

Citizens resident in the European Union, Iceland or Norway can such as property taxes, waste removal or fees for the homeowners’ association. They can also deduct other expenses, provided that they can show that they are financially linked to the rental activity, such as interest on loans, repair and maintenance expenses, electricity, insurances, water or gas expenses, etc.

When do you have to declare this IRNR with tax payment for renting out?

Payment for income obtained by citizens non-resident in Spain from the rental of their homes takes place quarterly through submitting form 210. If you own more than one property, one form must be submitted for each. This form must be submitted within the first 20 days of April, July, October and January, i.e. it is necessary to submit four forms per year, declaring the rental income for the 12 months of the year. Homeowners who rent out their properties as holiday rentals can submit, in the same form 210, all income received from rent for the three months declared, even if it comes from different tenants.

What can happen if I fail to declare rental income?

If the Spanish treasury detects you are renting your home without declaring anything, it will initiate proceedings to send you a settlement proposal, which will entail late interest due to declaring your income after the due date. Likewise, the treasury is sure to initiate a penalty procedure where you could end up paying a fine of 50% to 100% of what you failed to declare. Currently, thanks to the internet and digital home rental platforms, such as Airbnb, HomeAway, SpainHoliday and Tripadvisor, the Treasury has carried out several inspection campaigns over the last few years, requiring thousands of homeowners to regularise their rental situation.

What about the RTA rental license and the Guardia Civil?

To be able to publish your property on online rental platforms you need to have a RTA rental license of the Registro de Turismo de Andalucia, both for urban and rustic properties. If you don´t have this license yet, we could apply for it on your behalf and inform you about all official requirements that secure a safe and qualitative home to the renter for which you could get an inspection. Urban properties also need their Firsts Occupation License and if you don´t have this yet, we recommend that you contract an architect to apply for it at your Town Hall. Standard licenses for rustic properties (“alojamiento turistico”) have a limit of 90 days a year and you can´t offer extra services like breakfast.

The last thing that you need to know if you rent out your property to tourists, is that you are obliged to report all arrival within 24 hours to the Guardia Civil (Police) through their online platform.

What do I need to arrange?

Well, even if you don’t like paying taxes, just as most of us don’t, we advise that, if you are renting your home in Spain, you regularise the situation and submit form 210 so you can pay the treasury for the profit obtained from renting the home.

Author: Gustavo Calero Monereo, lawyer at C&D Solicitors Torrox (Málaga, Andalusia)