Spanish Inheritance Law

Spanish Inheritance Law

People who have lost a loved one unfortunately often are faced with a lot of practical issues for the funeral and the later inheritance process. If this person wasn´t of Spanish nationality but was resident in Spain or had assets here, it´s even difficult to know where to start with all the paperwork. Is there a Spanish last will (testament) or a will signed in another country? Which inheritance law applies, the Spanish one of the law of the country of the deceased? And will the heirs need to pay any inheritance tax in Andalusia or not?

C&D Solicitors in Torrox, Malaga, can help you with carrying out the complete Spanish inheritance process. We can do so on a full-service base and in our office we speak several languages like English, Dutch, Swedish and German. This way you don´t have to worry about the practical side of your loss. Of course we can also advise you in signing a Spanish will according to your specific situation. You´ll read all you need to know about Spanish inheritance law on this page or you can watch our information video (below) about this subject on this page.

The signing of the inheritance deeds at the notary

To be able to inscribe the deceased´s properties -like a house, bank account or car- in name of the legal heirs, it is always necessary to sign the Inheritance Deeds at the Spanish notary. Mostly this is done by a lawyer that represents the heirs through an official Power of Attorney. He will provide the notary both with the Death Certificate as an extract of the central registry stating if there was a Spanish Last Will and, if yes, where it was signed. In this case the notary of course also needs to receive a certified copy of this Last Will.

Which inheritance law applies?

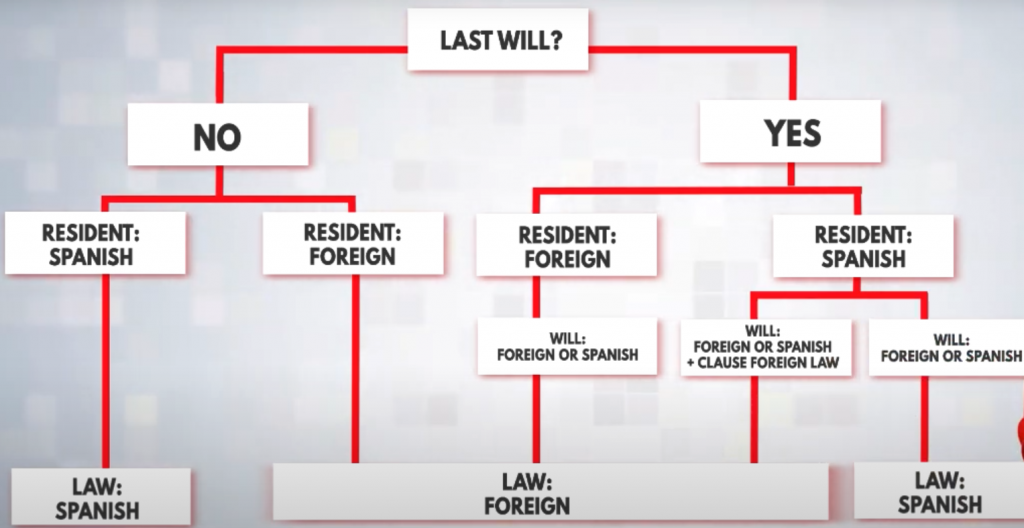

An essential question to determine in the inheritance deeds in which inheritance law applies; the Spanish or the foreign law of the deceased´s own country. In the diagram below and in our video you see that this matter is rather complex, but it´s very important as the Spanish law is rather inflexible. When it applies the biggest part of the properties always is inherited by the children or other family members. This means that if you are a married couple resident in Spain and you want the longest-living to inherit your belongings, you always need to sign a Last Will appointing your national law and your spouse as legal heir.

If the foreign law is in force additionally either a Probate document or a Declaration of the Law will be required by the notary which states who the legal heirs are according to the foreign law.

European Certificate of Succession instead of Declaration of Law?

In a view cases it´s also possible to use the relatively new international Certificate of Succession instead of the Declaration of Law. This can have costs benefits, but also has downsides. We advise you to read our article about this European Certificate of Succession for more information.

In which case do I pay inheritance or donation tax?

Nowadays inheritance or donation tax is the same for the Spanish, European residents or non-European residents in Spain but the percentage varies per autonomic state, like the Junta de Andalucia. In Andalusia heirs that are close family members like spouses, children, grandchildren or parents usually don´t pay inheritance or donation tax, but the declaration still needs to be done. Therefore, once the inheritance deeds are signed the lawyer will fill out the obliged forms and pay any taxes for heirs with another relation status. Depending on the official residency of the deceased he will send the documentation to either the Regional or National Tax Office. Next to that, the lawyer will make sure that the local Plusvalue tax is paid if applicable.

Of course C&D Solicitors is happy to look at the specific fiscal case of your Spanish belongings and can advise you about future inheritances (or donations) to keep the taxes and other costs as low as possible.

Inscribing properties in name of the legal heir(s)

When the inheritance deeds are returned with the right stamps the lawyer then can take care of the correct inscription of any real estate in the name of the new owner at the Land Registry and Cadaster. This document will also serve to change the title holders of a bank account or a car. The whole process from the signing of the deeds at the notary until the end of the project takes about 3 months. When the legal work finally is completed, we of course provide our clients with all bills, proof of payments, original documentation and the final balance of the total project.

Pre-search and sale of inherited property

However, as you can imagine, not all inheritance processes are completely the same and sometimes it´s necessary to take extra steps. In some cases -for example if the deceased wasn´t a close relative- it´s possible that our lawyers will conduct a pre-search in the different registries to find out if the person had any unknown assets in his or her name. It´s even possible that they take care of the sale of an inherited house if the new owners don´t wish to keep it. In this scenario the client will receive the mentioned final balance after which we´ll transfer the proportional net amount of the inheritance to the bank account of the legal heirs.